Contents:

It’s commonplace and can be found in various situations, but they usually exist to supply security for the lender or asset finance supplier. But if you don’t wish to lose ownership of your property, there are other options within the type of a Fixed or Floating charge. While goodwill officially has an indefinite life, impairment tests can be run to determine if its value has changed, due to an adverse financial event. If there is a change in value, that amount decreases the goodwill account on the balance sheet and is recognized as a loss on the income statement. When analyzing a company’s balance sheet, investors will therefore scrutinize what is behind its stated goodwill in order to determine whether that goodwill may need to be written off in the future.

- This judgement lien can be helpful to the defendant in getting paid back in a nonpayment case by liquidating the assets of the accused.

- That means they take precedence over unsecured creditors who should wait until all different prices and collectors have been paid earlier than they obtain any of the cash they’re owed.

- Upon crystallisation of a floating cost, the floating charge attaches to all existing assets which might be throughout the scope of the charge and becomes mounted.

- Accruals are revenues earned or expenses incurred which impact a company’s net income, although cash has not yet exchanged hands.

- Goodwill is an intangible asset that can relate to the value of the purchased company’s brand reputation, customer service, employee relationships, and intellectual property.

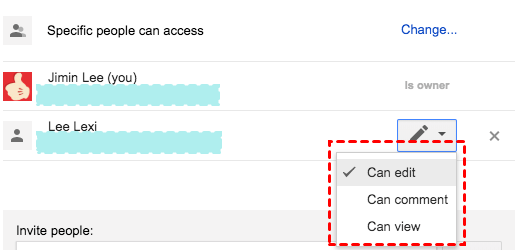

A shareholders’ agreement outlines the internal management framework of the company to effectively protect the overall interest of shareholders by setting out their rights and obligations. To print this article, all you need is to be registered or login on Mondaq.com. I am not a commerce background just want to know the merits and demerits of charge creation or thr requirements of its.

A fixed charge is any type of expense that recurs on a regular basis, regardless of the volume of business. Fixed charges mainly include loans and lease payments, but the definition of «fixed charges» may broaden out to include insurance, utilities, and taxes for the purposes of drawing up loan covenants by lenders. But in lots of cases there inevitably comes a degree at which the lender must enforce the charge, this is named an Event of Crystallisation.

Fixed Charge: Meaning and Examples in Corporate Finance

This is one of the best safety which can be created over the assets of any explicit company. The bank might require different safety from the administrators and may want their private guarantees. The debenture doc data that in any liquidation or another insolvency course of you will be repaid from company belongings before any unsecured creditors under what is known as your floating cost debenture. The Court additionally found that a floating cost is enforceable if a condition of enforcement has been satisfied and there may be an excellent debt secured by the floating charge.

No-Shop Clause: Meaning, Examples and Exceptions – Investopedia

No-Shop Clause: Meaning, Examples and Exceptions.

Posted: Sun, 26 Mar 2017 07:50:48 GMT [source]

A judgment lien is a court ruling giving a creditor the right to take possession of a debtor’s property if the debtor doesn’t fulfill their obligations. Dear Kanwaljit, This form is STP form and the certificate is generated at the time of making payment of the challan. Could you please clarify on the procedure for seeking condonation for failure to intimate to ROC the Satisfaction of charge within 30days.

Creating «Charges» Under The Companies Act, 2013

Julia Kagan is a charge on assets explain the term/consumer journalist and former senior editor, personal finance, of Investopedia. CAs, experts and businesses can get GST ready with ClearTax GST software & certification course. Our GST Software helps CAs, tax experts & business to manage returns & invoices in an easy manner. Our Goods & Services Tax course includes tutorial videos, guides and expert assistance to help you in mastering Goods and Services Tax. ClearTax can also help you in getting your business registered for Goods & Services Tax Law.

Goodwill Impairment: Definition, Examples, Standards, and Tests – Investopedia

Goodwill Impairment: Definition, Examples, Standards, and Tests.

Posted: Tue, 23 Feb 2021 08:00:00 GMT [source]

The reason for this is that, at the point of insolvency, the goodwill the company previously enjoyed has no resale value. Negative goodwill is usually seen in distressed sales and is recorded as income on the acquirer’s income statement. Retail banking consists of basic financial services, such as checking and savings accounts, sold to the general public via local branches.

How to Calculate Amortization of Loans

What is much less known is that directors can also use the debenture to safe their very own pursuits’ when lending to an organization. It can also be of great significance to debtors, as without the flexibility to take floating charges, lenders could be less inclined to lend. A mounted charge is safety awarded over a selected asset corresponding to a property or an asset.

In some cases, the opposite can also occur, with investors believing that the true value of a company’s goodwill is greater than that stated on its balance sheet. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy. If a Government company issues secured debentures which has Central or State Government’s guarantee, then it need not create any charge on its assets. Company has to create a charge on the assets of the company or its subsidiary company or holding company.

Classification of Assets: Physical Existence

The assets being secured for the loan are allowed to float or vary in price and quantity. Suppose, XYZ Ltd. registered under companies act, is into power supply by renewable source of energy to its clients or execute power projects on behalf of our clients. Where the special resolution is passed as required under section 180 of the Companies Act, 2013, form MGT14 of the Companies Rules, 2014 is to be files with the registrar. B) The registered will also be opened for inspection of any other person on payment of prescribed fee. C) The entry in the registered authenticated by a director or secretary of the company or the other person authorized.

The debenture is usually referred to as a ‘floating cost debenture’ and consists of all company belongings. The charge is floating as a few of the assets could also be changing every day, corresponding to inventory for example. A debenture in quite simple phrases is an agreement between a lender and a borrower which is registered at Companies House and lodged towards your organization’s belongings.

If the Director of the Company has offered his asset as mortgage for the loan taken by the company and his individual name. Do we have to create a ROC charge on the said asset of the Director for both the loans. Will anyone clear 3rd Proviso of Section 77 that any subsequent registration of charge shall not prejudice any right acquired on asset before the charge is actually registered . Pay the requisite penalty imposed by the Regional Director having territorial jurisdiction over the registered office of the company. Make entries in the register of Charges maintained in form CHG-7 forthwith after the creation/ modification/ satisfaction and get it authenticated by Director or Secretary of the company or any person authorized by the board. Provisions of Modification of charge are completely same as provisions of Creation of Charge.

With a fixed charge, the assets become fixed by the lender so the company cannot use the assets or sell them. CHG-1 would definitely be filed in case of Pledge, What is ‘Interest’ defined in Charge,,!!! According to me its the security intrest.A securityinterest is a type of property interest created by agreement or by operation of law over assets to secure the performance of an obligation, usually the payment of a debt.

This technique is used to reflect how the benefit of an asset is received by a company over time. Amortization is important because it helps businesses and investors understand and forecast their costs over time. It is also useful for future planning to understand what a company’s future debt balance will be in the future after a series of payments have already been made. This will embrace any failure to meet the terms of the mortgage (non-payment, etc.), or if the corporate goes into liquidation, ceases to commerce, and so forth. A floating charge will crystallise mechanically at widespread regulation on the incidence of sure events, such because the borrower ceasing to carry on its business or coming into into liquidation.

The fair value of the assets was $78.34 billion and the fair value of the liabilities was $45.56 billion. Thus, goodwill for the deal would be recognized as $3.07 billion ($35.85 billion – $32.78 billion), the amount over the difference between the fair value of the assets and liabilities. While normally this may not be a significant issue, it can become one when accountants look for ways to compare reported assets or net income between different companies .

Common expenses include payments to suppliers, employee wages, factory leases, and equipmentdepreciation. Negative amortization is when the size of a debt increases with each payment, even if you pay on time. This happens because the interest on the loan is greater than the amount of each payment. Negative amortization is particularly dangerous with credit cards, whose interest rates can be as high as 20% or even 30%. In order to avoid owing more money later, it is important to avoid over-borrowing and to pay your debts as quickly as possible. This is especially true when comparing depreciation to the amortization of a loan.

Amortization can be calculated using most modern financial calculators, spreadsheet software packages , or online amortization calculators. When entering into a loan agreement, the lender may provide a copy of the amortization schedule (or at least have identified the term of the loan in which payments must be made. Amortization can refer to the process of paying off debt over time in regular installments of interest and principal sufficient to repay the loan in full by its maturity date. A higher percentage of the flat monthly payment goes toward interest early in the loan, but with each subsequent payment, a greater percentage of it goes toward the loan’s principal. It is feasible that the worth of the company’s property is sufficient to cover the extent of money owed owed, and the business can proceed to function after the receivership.

- The beginning loan balance is amount of debt owed at the beginning of the period.

- If an organization fails to repay the mortgage or goes enters liquidation, the floating cost turns into crystallized or frozen into a hard and fast charge.

- The Registrar shall enter the memorandum of satisfaction of Charge and issue the certificate of registration of satisfaction of Charge in Form No.

- Expenses can also be defined as variable expenses; those that change with the change in production.

Goodwill is calculated by taking the purchase price of a company and subtracting the difference between the fair market value of the assets and liabilities. A finance charge, such as an interest rate, is assessed for the use of credit or the extension of existing credit. Yarilet Perez is an experienced multimedia journalist and fact-checker with a Master of Science in Journalism. She has worked in multiple cities covering breaking news, politics, education, and more.

What Is Asset Management, and What Do Asset Managers Do? – Investopedia

What Is Asset Management, and What Do Asset Managers Do?.

Posted: Tue, 31 May 2022 07:00:00 GMT [source]

Negative amortization may happen when the payments of a loan are lower than the accumulated interest, causing the borrower to owe more money instead of less. Intangibles are amortized over time to tie the cost of the asset to the revenues it generates, in accordance with the matching principle of generally accepted accounting principles . Amortization schedules are used by lenders, such as financial institutions, to present a loan repayment schedule based on a specific maturity date. Amy Fontinelle has more than 15 years of experience covering personal finance, corporate finance and investing. A leverage ratio is any one of several financial measurements that look at how much capital comes in the form of debt, or that assesses the ability of a company to meet financial obligations.

Not every business owns assets which are able to a mortgage or fixed cost; they could lease their premises or have machinery on rent purchase agreements. A fixed cost applies to a selected identifiable asset, while a floating cost is dynamic in nature and customarily applies to the whole of the company’s property. A unfavorable pledge clause is a type of unfavorable covenant that prevents a borrower from pledging any belongings if doing so would jeopardize the lender’s safety. This type of clause could also be part of bond indentures and traditional mortgage buildings. For instance, understanding which assets are current property and which are fixed belongings is important in understanding the web working capital of a company.